When my mother passed away, my two siblings and I inherited her home, each of us owning one-third of the property. After careful consideration, I decided to purchase their shares with the goal of renovating and converting the home into a rental property.

I reached out to the real estate agent who helped me buy my current home, and his first piece of advice was: get an appraisal—or even multiple appraisals—to determine the home’s market value. Since my previous home purchases were done through the VA (which handled the appraisals and inspections for me), I had no experience hiring one on my own.

County Appraisers vs. Private Appraisers: What I Learned

My first instinct was to call the county appraisal office, but they informed me that county appraisers do not conduct private appraisals for individual property sales. Their role is to assess property values for tax purposes only.

According to the Florida Department of Revenue, a county appraiser is an elected official responsible for determining the market value of all property within their jurisdiction as of January 1st each year. After applying exemptions and limitations, the office calculates each property’s taxable value.

Hiring a Private Appraiser for the Home Purchase

To move forward with buying out my siblings, I hired a private appraiser to complete a full appraisal—which includes both the interior and exterior of the home. Since I already owned one-third of the property, I purchased the remaining two-thirds based on the appraised value.

➡️ Read more about that process here: Purchasing the Shares of Siblings Out of an Inherited Home

Later, when I applied for a home equity loan through Rocket Mortgage to fund renovations, another full appraisal was required—this time arranged through the lender. The results allowed me to borrow up to 80% of the home’s appraised value.

If you’re looking for a private appraiser, consider:

- Asking your real estate agent or lender for referrals

- Checking platforms like Angi (formerly Angie’s List) or Thumbtack

- Talking to friends, family, or colleagues for recommendations

What to Expect from a Full Appraisal

The on-site visit took less than an hour since the townhouse is fairly small. Within 48 hours, I received a comprehensive appraisal report that included:

- Interior and exterior photos

- A detailed property description

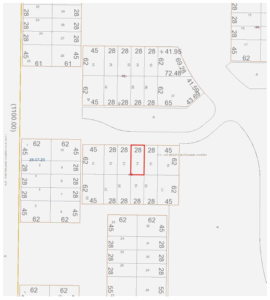

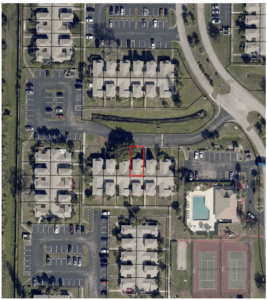

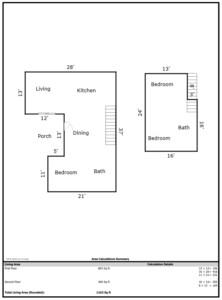

- Street views, property line map, and building sketches

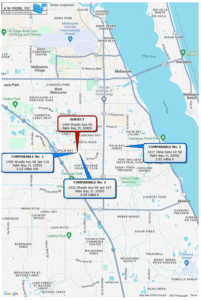

- Photos and descriptions of comparable homes (comps)

- Location maps showing proximity to other homes

Property line map included in the full appraisal report, showing the exact lot location and dimensions.

Aerial view showing the surrounding neighborhood and the townhouse unit highlighted in red.

Floorplan sketch included in the appraisal report, showing the square footage and room layout for both floors.

Location map showing the subject property and three comparable properties used in the appraisal.

Setting the Rent Price

To estimate a competitive rental price, I researched similar townhouses in the area. As the renovation neared completion, I hired a property manager who also conducted a rental market analysis. They provided insight into fair market value based on local trends and features.

📌 In a future post, I’ll discuss how I chose a property manager and why that decision worked for me. But if you prefer to manage your own rental property, that’s a perfectly valid route too!

Home Insurance: Required Inspections for Older Homes

Since the estate homeowner’s insurance policy was ending, I began working with my insurer to establish a new policy in my name. The process involved multiple inspections that were unfamiliar to me:

Wind Mitigation Inspection

My insurance agent advised a wind mitigation test, which evaluates how well the home would withstand hurricane-force winds. This was performed by a home inspector, not an appraiser.

What’s the Difference Between an Appraiser and Inspector?

- Appraiser: Evaluates the property’s market value based on condition and recent comparable sales.

- Inspector: Examines the home for structural or system issues (roof, plumbing, HVAC, etc.)

(📚 Source: Rocket Mortgage – Appraisal vs. Inspection)

4-Point Inspection

Next, my insurance company required a 4-point inspection because the home is over 40 years old. This inspection evaluates:

- Roof

- Plumbing

- Electrical systems

- HVAC (Heating, Ventilation, Air Conditioning)

At the time of writing this, I’m waiting to replace the HVAC compressor before scheduling the inspection. Once complete, I’ll submit all documentation to finalize my insurance policy.

Final Thoughts

If you’re navigating home purchases, renovations, or converting an inherited property into a rental, these appraisal and inspection processes can be overwhelming—but manageable with the right information.

Your best assets will be reliable professionals, a clear timeline, and a bit of patience as you work through each step.

References

- Chase: What to Know About Home Appraisals

- The CE Shop: Types of Real Estate Appraisals

- Appraisal Institute: How Consumers Interact with Appraisers](https://www.appraisalinstitute.org/the-appraisal-profession/how-consumers-interact-with-appraisers#:~:text=How does an appraiser estimate,require for a similar home)

- Rocket Mortgage: Appraisal vs. Inspection

Featured Photo by Adrien Olichon from Burst – A Powder Blue Home Under A Blue Sky